Get your free online quote

Australia

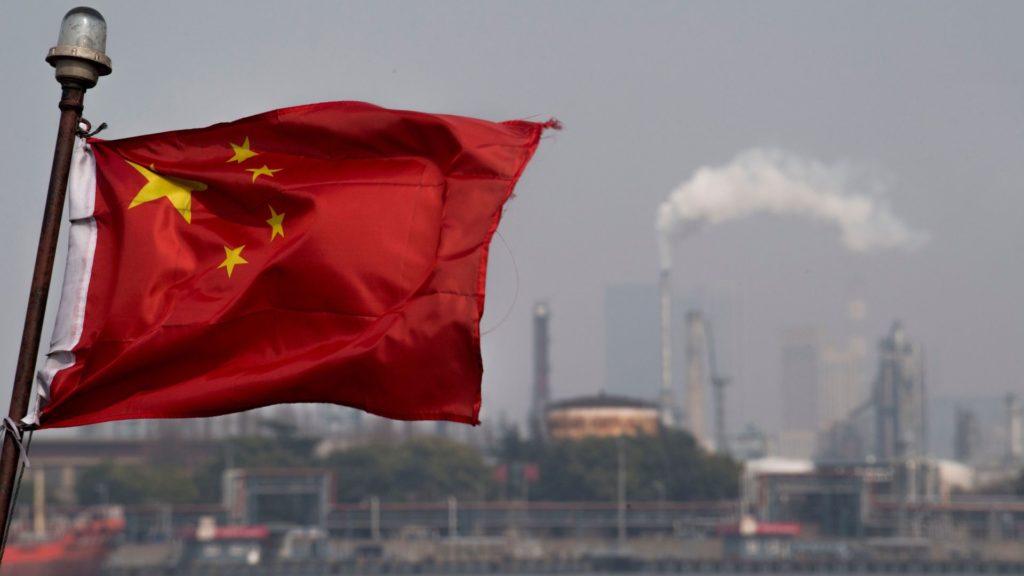

The Australian Dollar has been volatile in the past 24 hours after starting the week at 0.7080. The FOMC minutes bought nothing new to markets Thursday morning as they highlighted ongoing global uncertainty and the possible flow on effects from a slowdown in Europe and China. Equities all closed higher with the Aussie Dollar holding recent strength. Wage growth in Australia went backwards in the December quarter according to statistics wage growth grew by 0.5% coming in below the expected 0.6% pace expected. Unemployment data came in better than expected Thursday when employment was higher for January with employment jumping by 39,000 with 65,400 additional fulltime people and a downturn of 26,300 part time people. The wage data pushed the Aussie higher across the board on the news, against the greenback to 0.7205. Within minutes however, the AUD was back under pressure after Westpac suggested the RBA will cut interest rate twice this year. Overnight, reports of China blocking Australian imports of coal pressured the AUD further.

New Zealand

Prices in the Global Dairy Auction held overnight Wednesday showed another healthy rise of 0.9% increase, this is the sixth consecutive price increase. A total of 25325 Metric Tones of product was sold with milk powder and cheddar making the most gains of around 2.8% and 2.95% respectively. President Trump earlier comments to media were positive at the end of last week’s Beijing trade talks. He said the meetings went “extremely well” with further talks expected to continue today and tomorrow in Washington. The meeting in part will cover the pledge by China to purchase a significant amount of goods and services from the US. The US have highlighted the need for structural changes to be made in China. China more than ever looks to be engaged to reach a deal with the US. Next week’s main event on the docket will be Retail Sales ending January quarter.

United States

The President and the White House are continuing with shifting Billions of federal funds to fund construction of Trump’s border wall. Despite several lawsuits challenging Trump’s authority to declare a national emergency the white house doesn’t plan to use the funds sourced by the national emergency but instead use funds to build his wall from the defence department drug program and Treasury dept asset forfeiture fund. Both these funds together will provide a total of 3.1 Billion. In line with Trump’s campaign promise he is certainly going hard to show his supporters he is prepared to take dramatic action to get the job done – importantly prior to potentially being re-elected in 2020. The Fed minutes didn’t bring about any changes to current policy with no expectation of any further rate hikes for 2019

United Kingdom

The English are starting to buy up Euros as the Brexit deadline draws closer. Figures out are suggesting purchasers of Euro are up by matching the statistics of recent years with 36 days left until the UK leave the European Union. In the latest chats between Theresa May and Jean-Claude Juncker in Brussels have discussed all things Brexit concentrating on the problem area of the Irish Backdrop. May said she needed legally binding changes made if MP’s were to back the deal. The two will speak again by the end of February. Chief negotiator Barnier will look at alternative arrangements if they agreed to replacing the contested Irish Backdrop at a later stage. In other news UK employment has hit another record high with figures showing 32.6 Million people were employed in the last quarter of 2018. The unemployment rate at 4.0% is the lowest it’s been since 1975. Next week BoE will release their current inflation and future monetary outlook.

Europe

The Euro bottomed out at 1.1235 before a optimism returned back into play with the Euro reversing losses to 1.1370 against the bearish weakened greenback. Significant to this move is the break higher from the bearish move from 1.1515 as the Euro looks to improve. While we have also a lot of USD risk with the US political scene, yields are still showing plenty of room for bigger adjustment from the Fed. The bi-product of this, are chances the EUR will trade back towards the yearly high of 1.1600 over the next few months. Yesterday’s Fed minutes was benign with no real change to current policy for now, and a wait and see approach over the next few months. French and German Manufacturing figures released overnight with mixed results sending the Euro all over the park eventually settling at 1.1330

Japan

The Japanese Yen has been the weakest performer this week depreciating against all main currencies and relenting over 1.65% versus the British Pound. Risk sentiment has followed through from last week with positive comments coming from the US and China trade talks. Over the following two days we will get a better feel for where negotiations are at with China now prepared more than ever to make a deal when they speak in Washington. Japan posted a surprising and rare trade deficit for January when the number printed at -0.37 Trillion after 0.17 Trillion was expected. This put pressure on the Japanese Yen in the lead up to manufacturing data Thursday which also came in worse than expected at 48.5 compared to 50.4 markets were expected. This was the weakest result over the past two years and shows a significant downturn in the manufacturing sector. Japanese CPI prints next week for January and is expected to be in line with December numbers around 0.4%

Canada

With a recent weaker US Dollar and improving Crude Oil prices back over 56.50 we have seen price move off 1.3250 levels to 1.3158 Thursday versus the greenback. In 2019 OECD oil levels are expected to increase through to June with projected totals expected to end at 2.96 million barrels. For 2020 stocks are projected to be 105 million more to end 2020 around 4.06 million barrels, with these numbers so high the price could be compromised and travel significantly lower. Markets remain confident over the US/ China trade dispute, risk appetite suiting the CAD. Washington talks are resuming now as both sides look to ease tensions after months of global pain and uncertainty. The Bank of Canada’s Poloz spoke during the night and said interest rates need to be higher to keep inflation in check, although the timing of raising rates in the future remains unclear because of the hazy outlook for global trade. Canadian Retail Sales print early tomorrow.

Get your free online quote