Direct FX

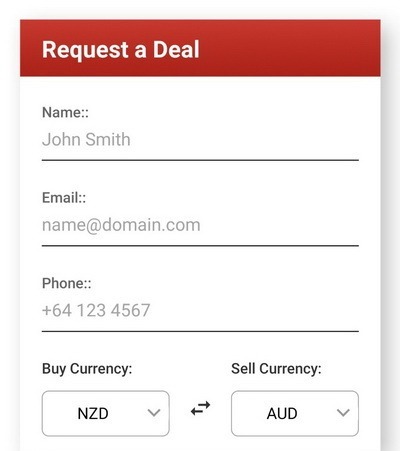

Contact us via our mobile app or site, get a quote, send us the funds and we will exchange the currency and transfer it to the requested bank account.

Billions of NZD exchanged

We exchange equivalent of 100 billion NZD exchanged annually.No fees

We charge no transaction fees. We will not be beaten on price.In the business from 2001

Our 6 advisors together have 150+ years of experience arranging currency exchanges.How do we help you?

We help you save money on banking fees when you need to send or receive funds in another currency.

Personal Currency Transfers

Business Currency Transfers

Who do we service?

We help businesses, banks and individuals save on foreign exchange.

Why us?

Here is why we are a better solution than traditional banks.

No fees

We charge no transaction fees. We build our fees and margins into the rate we quote you (in most cases).150 years of combined experience

Combined we have over 150 years of experience giving advice to and arranging currency transactions for bank treasury currency traders.We use plain English

We give general product advice in plain English. We explain the choices, benefits, and risks of foreign exchange productsGlobal bank payment system understanding

We have thorouh knowledge and vast experience with the global bank payment system.Informed decisions

Our general product advice helps clients make informed decisions about personal and business currency transfers.Direct lines to all major bank treasuries

We have direct phone lines of communication with all major bank treasuries in Australasia.No Fees

We charge no fees. You get one quote and everything is included in it.

Manage Your Forex in No Time

It takes only a few minutes to register an account. After that, you’ll receive further instructions on how to transfer the funds. Once the funds are in our accounts you can begin trading. It is that easy!

Client Testimonials

We are proud that 438+ customers rated us 4.9/5 on TrustPilot. Here are some of their reviews.

Wouldn’t now go anywhere else

Date of experience: 12 July 2022I wouldn’t use anyone else

Date of experience: 22 December 2021I’ve always found DFX to be a great way…

Date of experience: 29 March 2022We Are Available Worldwide

Direct FX accepts transfers from most countries with a few exceptions like Cuba, Iran and Iraq. Contact us if you wish to confirm we can receive payment from the country you require.